Money is just pieces of paper or numbers on the account. But it reallt matters what you convert them into. And, no matter how strange it may seem, these very pieces of paper have a very strong effect on your well-being and mood.

Table of Contents:

- “The Greatest Wealth Is Health” Meaning

- How Financial Stress Impacts Health

- How Mental Health and Money Are Connected

- The Link Between Financial Wellness and Physical Health

- Here’s How Financial Education Can Improve Your Health

- 9 Criteria That Determine Your Financial Well-Being

- 5 Tips to Improve Your Financial Health

“Your Health Is Your Wealth” Meaning

Health is the greatest wealth and the most precious thing that an individual can have in this world. It typically wins in the “health vs money” battle. Good health provides you with a long and active life, helps achieve your goals and overcome difficulties, and also enables you to successfully solve life’s tasks.

A healthy person can be considered a person who is physically and mentally healthy, always has a good mood and high self-esteem. Human health is formed under the influence of a complex set of internal factors and external influences. In the course of many years of research, scientists have concluded what our health depends on.

The main components of a healthy lifestyle are a healthy diet, the absence of bad habits, personal hygiene, adherence to a regimen, outdoor sports, good mood and a favorable environment. If everything is in order, then the immune system will easily fight back any sore. Do not forget that the immune system loves protein. Therefore, you should eat eggs, nuts, milk, fish and meat. In addition, the immune system is very fond of tempering. To begin with, you should rub the body with a damp warm towel, then cool, then pour over.

When you take care of your health, you choose the best doctors, fresh food, a good social circle. Women can even choose the best beauty salons, which provide a variety of services. They treat it so responsibly that they follow every innovation in the world of beauty.

It should be noted that the more carefully you treat your health, the more likely it is that you will live a long happy life.

Watch a video to find out what is more important: health or wealth. This quick and inspiring talk in the form of whiteboard animation will put it into perspective:

What Impact Can Financial Stress Have on Your Health?

People with low wealth are more at risk of mental illness. True, the big question is what is the cause and what is the effect. Perhaps a person with depression, an anxiety disorder, or other mental disabilities finds it more difficult to get a stable job.

More than a hundred studies have been devoted to this issue, which were conducted in dozens of different countries. 80% of studies have shown that people with low incomes are more likely to have mental disorders, while they are more pronounced and last longer.

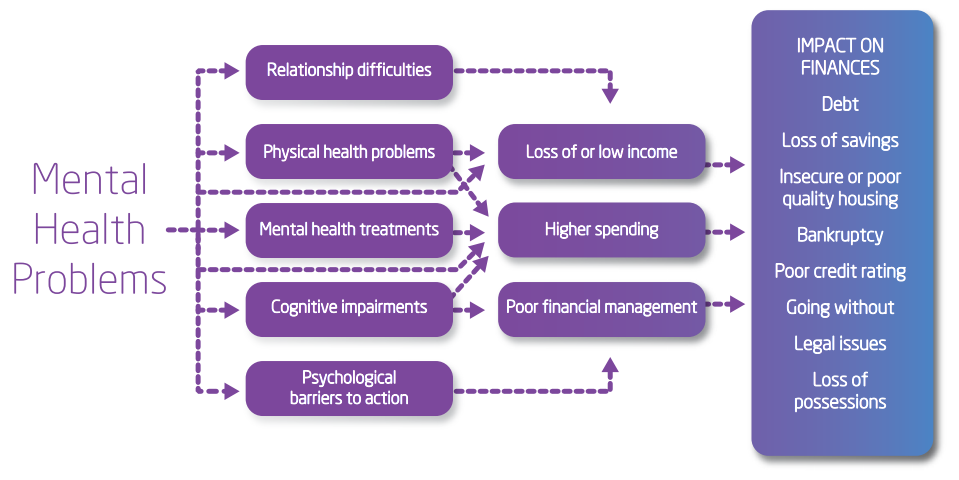

The data below shows the strong link between financial and mental wellness:

Of course, blaming poverty alone for psychological difficulties is unfair. “It may be one factor that plays a role in combination with genetics and life events,” says University of Cape Town psychologist Crick Land, who studies mental health policy. But, he says, the most compelling research so far shows that it is poverty that leads to mental illness, not the other way around. First of all, it can threaten depression.

As the scientist explains, there is one difficulty with research in this area: experimenters cannot artificially make the subjects poor for a long time. So it remains to rely on data obtained in a non-experimental way: if in some locality unemployment rises or the average income level falls, the likelihood of depression also increases.

It works the other way around too: A recent study by Swedish scientists found that people who won the lottery or received large unexpected payouts used less anti-anxiety drugs and sleeping pills.

The Relationship Between Mental Health and Wealth

We’ve already talked about how low incomes affect health: poor people are more likely to get heart disease, diabetes, tuberculosis and HIV, seek less help from doctors and die earlier.

And money is also associated with various mental disorders: poor people have them more often. For example, people with low incomes are more likely to get depressed and commit suicide.

It may seem that the connection between money and mental health is obvious: of course, money is linked to our mental health. But how exactly?

80% of workers say money worries affect their performance

Let’s start with the fact that financial problems affect the state during work. The University of Cambridge and research center RAND Europe found that the average employee loses 38 work days per year, less due to absenteeism and more due to presenteeism. This is the name of the state when a person is at the workplace but cannot do anything because he is worried about personal problems.

For employees with financial problems, these figures are twice as high: a person is so worried that his concentration and motivation decrease, he cannot concentrate on a work task.

At the same time, presenteeism can exacerbate illness, burnout, and psychosomatic problems.

Lack of money causes psychological distress

At the end of 2021, 11% of US residents did not have enough money for food, and 14% of Canadians had large debts.

In a 2022 study, researchers noted that women aged 18 to 29 and people with low incomes experience the greatest psychological distress. At the same time, married people feel a little better. At the same time, psychological distress is associated with emotional exhaustion, reduced immune response, heart disease, and increased mortality.

It turns out that millions of people around the world have health problems and die earlier because they have a strong anxiety about money.

At the same time, the prevalence of mental illness is only growing: according to the US National Institute of Health Management, by 8%. And if we talk about serious diseases, then by 24%. And the British Institute of Money and Mental Health believes that the lack of money directly affects mental health.

Debt affects mental health

In addition to poverty, mental health is affected by debt, as evidenced by a number of studies. But not all studies take into account a subjective assessment of the financial situation: a person may have a small loan, but he believes that he earns little, cannot repay the debt, and is worried about this.

For mental health, subjective assessment is more important than objective measures of debt because people react differently to financial difficulties.

One family pays off a mortgage debt stress-free because they have a good education, they earn enough and are sure that they can always find a job or ask family or friends for help.

Another family also repays a home loan,but constantly worries and dreams of paying off the mortgage faster. This is because they are not sure about the future: there is no support from family, but there is a fear of losing their job and not finding a new one.

We gave examples on mortgages for a reason: scientists studied the relationship between housing instability and severe health consequences. They found that people who pay their rent worry less than those who rent, as long as they have enough money for a mortgage. But if there is difficulty repaying the loan, the level of stress is comparable to what people experience during a divorce or when they lose their jobs. Many Americans tend to take small payday loans from 1stsouth.com in order to relieve financial stress and make mortgage payments on time. It is an unsecured, short-term loan that typically ranges between $100 and $1,000. The most significant advantage for many borrowers is that payday loans are convenient and quick to access. They have fewer requirements than other loan, and you can get approved with bad credit.

And even people with the same income can have different levels of anxiety about money because they have different spending, habits and needs for food, health care, housing and transportation. That is, one person with a monthly income of $5,000 will feel comfortable, and the other will panic because this money is not enough for his needs.

Financial stress can happen to anyone

Recently, Canada’s Manulife Bank commissioned a study on the relationship between debt and stress. Researchers polled 2003 Canadians aged 20 to 69 and found that half of the people their debts cause stress, depression, and a third of those surveyed do not sleep well at night because they worry about debt.

This is not the only study of the relationship between money and stress in Canada: according to other data, 48% of Canadians do not sleep because of financial problems, and 44% will not be able to meet financial obligations if their paycheck is delayed.

And in the USA, more than 40% of people experience both debt and mental health problems.

At the same time, stress is caused not only by low wages and high debt levels but also by managing household expenses, having to pay bills, unexpected expenses, and the desire to have savings.

Anyone can have this financial stress: residents of different countries, those with different levels of income and expenses.

Rich people are actually happier

It is believed that money and happiness are connected only up to a certain level: in the US it is $75,000 a year. These results were obtained by researchers from Princeton University in 2010.

But according to a new study from 2022, there may not be a monetary threshold at which the importance of money decreases. And people with higher earnings experience an increased sense of control over their lives and therefore may feel happier than others.

Poverty is a risk factor for mental health conditions in childhood

Mental and financial problems start in the family: young people from poor families or survivors of childhood trauma are more likely to experience financial and mental vulnerability. It is also believed that childhood poverty can lead to poor mental health in adulthood. The story is similar in older people: if a person experienced financial difficulties most of his life, then in old age he is more likely to experience depression.

The connection between money and mental health works in two directions: financial problems cause mental disorders and, conversely, people with mental disorders are more likely to have money problems.

Scientists believe that people with debt are three times more likely to develop depression and anxiety. And there is an even stronger connection between suicide and debt: people who decide to commit suicide are eight times more likely to be in debt.

Because of this duality, scientists cannot agree on which comes first: mental problems or financial ones. Like chicken and egg. Some believe that worrying about debt leads to increased stress and reduced mental stability, while others believe that mental health problems interfere with financial management, reduce self-control and increase spending. In addition, mental problems can interfere with work, which significantly affects well-being.

It is possible that the truth is somewhere in between: debt increases the risk of mental problems, and mental problems can drag you even deeper into debt. This can be sorted out if you contact a psychiatrist for help: when a person is mentally healthy, it is easier for him to improve his life and pay off debts.

If you have temporary financial problems and feel overwhelmed, try to continue living as usual: make your bed in the morning, walk the dog, meet friends, not skip meals and not get addicted to alcohol. This will help at least not aggravate the mental state.

How Financial & Physical Health Are Connected

As we have already found out, money affects the human psyche. This fact is easily confirmed by personal experience. For example, when a job is lost, the level of security decreases and anxiety appears. But the body can also change under the influence of money and respond to the financial condition.

How is the body related to the mind?

The body is the subconscious turned inside out. It reflects everything that happens at the level of emotions, feelings, situations, events in the external life and in the inner world of a person. The body stores information about the first love, conflicts and disappointments. All our ailments, features of the constitution, wrinkles on the face are a reflection of our experience.

The body is the material manifestation of a person in this world. Money is also materialized energy. They are connected with the body through the subconscious, or certain programs, installations. If there is a need to improve your financial situation, you must first take care of your health, exercise and eat right because the first thing we can influence is our body.

Of course, income will not grow you just start going to the gym or treat chronic diseases. Other targeted actions will also be required. When you correct your well-being, you improve the flow of energy in the body. If you have blocks or clamps somewhere inside, then the body cannot withstand a large amount of money, which is also energy.

Disease and money: how are they related?

Constant money problems can be associated with negative attitudes. Some people have attitudes that are held subconsciously and affect the way individuals feel and think about others around them. These includes:

- “money is evil”;

- “money equals death”;

- “the rich are thieves”;

- “you have to work hard to have a lot of money”;

- “big money spoils people”, etc.

If there are such beliefs, the body simply cannot physically carry big money. The body reacts to such a situation with diseases, a general deterioration in the condition. And the person cannot explain what it is connected with. So the subconscious protects us from negativity because we recognized that “money equals death.” A person subconsciously seeks to get rid of money in order to feel better, through squandering, uncontrolled shopping and more.

Sometimes people have a belief that you can earn money only by hard work, sacrificing your body. These can be generic attitudes, if the ancestors from generation to generation worked in the field, in heavy industries. The result of such programs are diseases when trying to earn big money.

Money & Your Mental Health: Why Financial Literacy Matters

At Creighton University (USA), scientists investigated how financial literacy can affect health. The conclusions turned out to be interesting.

Principal Investigator and Associate Professor of Pharmacy at Creighton University, Nicole White, noted that increasing literacy reduces financial stress. Ultimately, overall health improves. The results are published in the American Journal of Lifestyle Medicine.

The study was attended by 345 working, low-income, single mothers from Omaha. Age ranged from 19 to 55 years. The participants were divided into two groups.

The first is those who completed the nine-week financial success course. The second is women who have not received any financial literacy training.

The study tracked participants’ health status. The researchers assessed blood pressure, cholesterol levels, weight, and perceived quality of life. The study found that participants who completed a financial education course exhibited a range of healthier behaviors compared to those who did not.

They knew how to set goals and prioritize, plan a budget and record expenses, save money on purchases wisely, and pay bills on time. They borrowed less, used credit cards less often, and did not overspend money in bank accounts.

In addition, health has improved. Financial stress lowered, tobacco consumption was reduced by 5%. People became more attentive to health and did not refuse the necessary medical care.

What Determines Financial Wellbeing?

Criterion 1. You have a financial goal

Financial goals answer the question: “What do I really want from life?” This is the first link between financial health and mental health. Any psychologist will tell you: you need to be able to want something big. Choose a direction in life and move in that direction.

If this is still difficult for you, you may use a financial goal which is suitable for everyone: find a source of passive income for retirement.

Calculate how much capital you need. The main thing is that it “ignites” you. Then it will be easier for you to concentrate on money management.

Criterion 2. Your expenses are less than your income

There is a misconception: “When I start earning more, than I will save. Right now I’m living from paycheck to paycheck.” That doesn’t work. If you already have a habit of spending everything, then it will stay with you for ever, no matter how much you earn.

Try the “pay yourself first” trick: if you get the money, save it right away. And adjust your needs according to the remaining amount.

There are many life hacks to spend less. First, learn to let go of emotional buying. And again we return to mental health. If you buy things to feel better, it’s worth working with a psychologist.

Criterion 3. Your income grows at least 10% per year

It is worth increasing your income up to 10% per year (or even up to 15%, if possible). It is normal for any professional to get better year by year and earn more.

Successful people usually think about whether they are doing it and whether they want to continue. To earn more, you need to delve into the profession. This is another money question that isn’t really about money.

Criterion 4. You save money regularly

Saving money regularly is the only sensible way to build big capital and achieve financial goals. You can look for a way to get guaranteed 200% per year or hope for a lottery. But it’s better to rely on yourself. Saving regularly means relying on yourself.

For example, you have a child, and you save up for a college. If you have just started saving and are saving $300 every month for 17 years to an account with 12% per annum, then by the time your child enters a college, you will have $200,000. For only $300 per month!

Learn more about how to save money regularly.

Criterion 5. You have an emergency fund

An emergency fund is needed in case of loss of income. To calculate it, multiply your family’s monthly expenses by 3.

This money should not be spent on current consumption, impulsive purchases, early loan repayments, down payments on mortgages and investments.

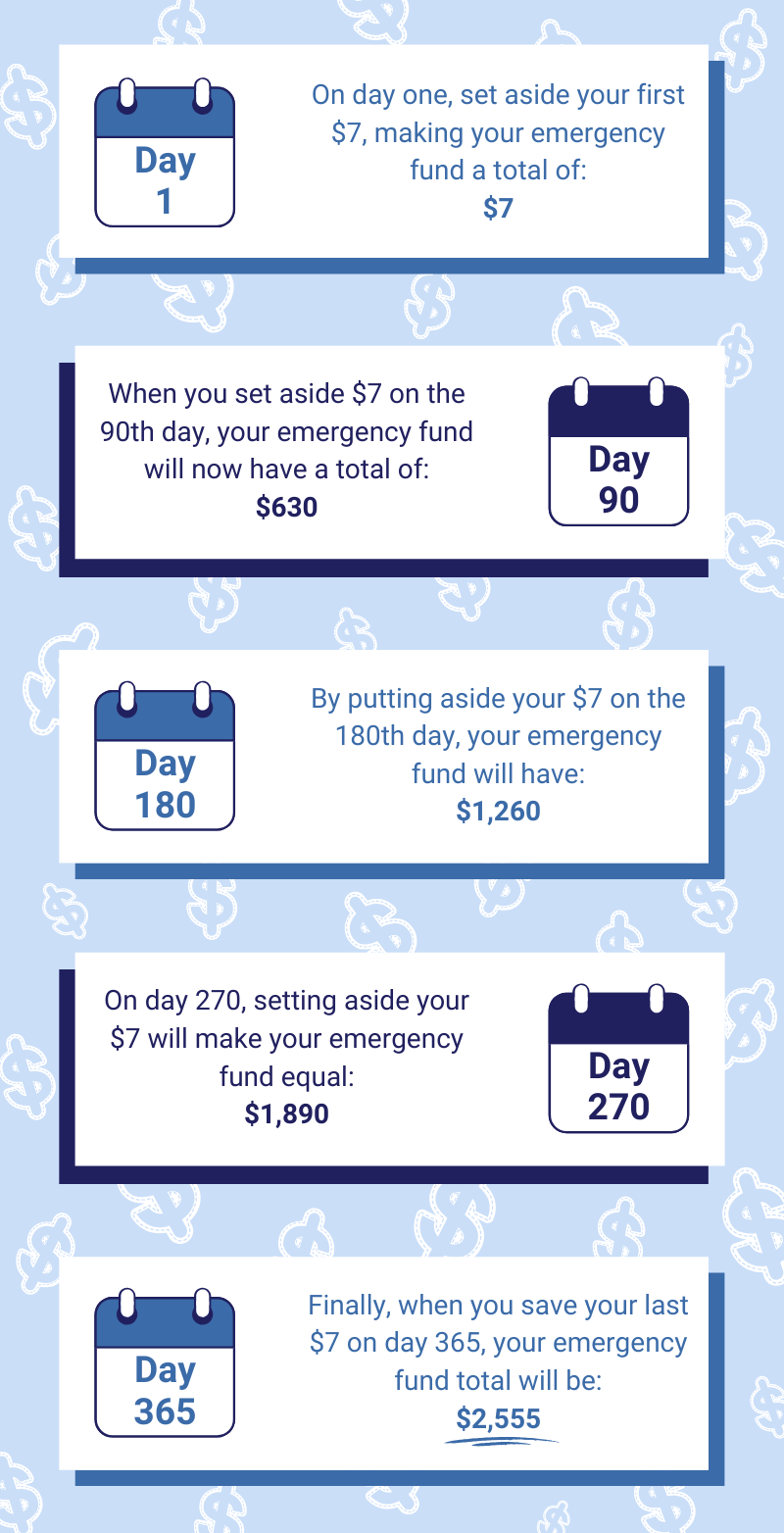

Take a look below to see how you could benefit from building your emergency fund with $7 a day:

Criterion 6. You get the maximum return on assets, and your assets grow

Approximately 90% of people have unused assets that could generate income. Assets are bank accounts and deposits, securities, real estate, land, property, transport, precious metals, shares in business, funds lent.

On the Internet, you can find many ideas of income producing assets that supposedly bring a lot of money with almost no investment of time and effort.

In any case, you must first understand what assets you have and how much they bring. The most unprofitable assets should be sold. And then later find new ways to acquire assets.

Criterion 7. Your debt load is less than a third of your income

The topic of loans is the most painful. Why do people with high incomes take out new loans to pay off old ones? This is a topic for a conversation with a psychologist.

But loans are also good if:

- they are taken for asset acquisition, not consumption;

- the return on these assets is greater than the cost of servicing loans.

Financial experts recommend doing this with loans. If the interest rate is more than 12%, direct all resources to close the loan as quickly as possible. If the rate is from 6 to 12%, pay off early and invest in parallel. If the rate is less than 6%, make payments according to the schedule and do not rush anywhere.

How are the things going with credit cards? If you can’t stop using a credit card, and the interest-free period has long ended, then reduce the limit on the card with each payment. This is how you break the vicious circle. To do this, inform the bank that you want to reduce the limit. Reduce it gradually until you completely stop living on credit money.

Criterion 8. Your health and property are insured

You need to insure yourself and property. If something bad happens, you will have to spend money to fix everything (for example, you were flooded by a neighbor) or to help yourself get out (for example, an injury). Since these expenses are unplanned, you pull money out of brokerage accounts or “bite off” capital to achieve a financial goal. Or you may need to take out a loan. Thus, you throw yourself a few steps back. Insurance programs will protect you from this.

Criterion 9. You invest, but do it wisely

With investments, you can earn more than 12% return on invested capital. For private investors, we recommend a portfolio strategy. Create an investment portfolio and try to twitch less. Create an information vacuum around you: no investment ideas, no “market signals”. In this regard, it is useful to work with a financial advisor: it filters all market information and suggests actions that are right for you.

5 Simple Ways to Improve Your Financial Health

- Decide what money means to you. What does finance mean to you? Is it just a goal or a tool to do something with your life? Do you have plans? Check your list of values and maybe this will clear things up for you.

- Find out how much you are worth. Open your bank statement, look at your payroll, check your retirement savings, find out what your credit score is. Don’t be afraid to find out the answer to these questions. Know where you are. This will help you determine how you can improve the situation.

- Track how you spend money. Look at your behavior regarding money. We overpay not only when we buy the necessary sofa or the desired car. Often our expenses are small things that add up to substantial amounts. Do you have spending habits that are inconsistent with your values and are they healthy? Answer these questions honestly

- Discuss money with your partner, family, friends. We recommend talking about money with your partner, family and friends, suggesting that you study relevant literature together and ask for their opinion. By the way, discussing finances in a couple can have a fruitful effect on the relationship.

- Think ahead. Focus on the long term. Once you’ve sorted out your short-term savings and emergency fund, you can start thinking about where you might be in 30 years. How do you want your life to look like? By answering this question, you can start saving money for this person and this future.

To attract more money into your life, you can also use these money affirmations. Listen to this every night:

Now you now why health is wealth and how health and money are connected. We wish you financial, mental and all other types of health that are important to you!